Chamicka Pollock | The Truth About "Experts"

7Newswire

22 Apr 2022, 13:03 GMT+10

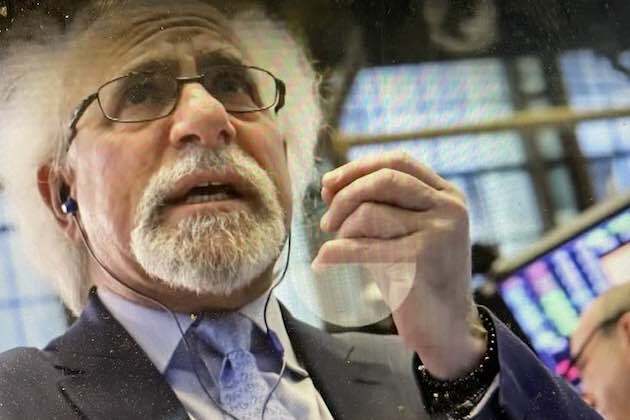

People always walk up to me and ask "Chamicka Pollock what's your take on this and that?" What's your take on cryptos? How do you think the whole Ukraine - Putin standoff is going to affect the market? Inflation, right… is there a way out? What should I invest in? And all I can do is give them a learned, educated, informed, guess. Not a certainty, but a very eagle-eye speculation. And that is really what all financial gurus can give you. In this piece, I'm going to take you behind the scenes at why economic predictors are nothing more than parlor games. And, why, you should always take with a grain of salt whatever comes out of someone that's doing the Nostradamus hustle.

"There's always something to worry about.'

Way back in the late 90s, international investment big-shot, Peter Lynch was asked in a press conference the following question: "what is your take on economic predictors?" Basically what he thought about the whole idea of staring deep into a crystal ball and then betting on the market based on what the spirits - or economic gurus - told him. If there was a way to predict how the market was going to move.

His response was brilliant — what you would expect on average for almost 12 years a 29.2% annual return, beating by more than double the S&P 500 market index. The answer was to the point, cutting, witty, the whole nine-yard. Do you know what he told reporters?

"… There's always something to worry about."

Then, without further ado, Peter flew into a masterclass on why he thought it was near impossible to predict the market. Why it's foolish to even try. And why you should never base your strategy on what a couple of apparently super-in-the-known talking heads tell you. Not only that, the man did a 180 and somehow tied his philosophy to everyday life. In other words, stick to your strategy, cause there's always something to worry about.

Peter basically said that every day of the week, there's going to be a new freak out about something, a new report on something, a new item to blow out of proportion. Every day of the week the market was going to act erratic — today, thanks to the fact that everyone with a cellphone can invest in the market, and that it's become a democratized open space - no longer governed by brokers - that idea is even more prevailing — more on that later.

The Flawed Science Of Economic Forecasting.

Peter named that phenomenon "the flawed science of economic forecasting." And, it's not just something that Peter Lynch made up, i/ts something that has a scientific basis.

For ages now, ever since Friedrich Hayek - Nobel prize winner in the economy, - the world has not only known that financial predictions are flawed, but that their overall language has "deplorable effects" on the way the public operates. And it's not just predictions based on the economy but absolutely everything. Fortune cookies have a better chance of foreseeing the future. Why? The problem with precognition is both mathematical as well as sociological slash psychological.

Let's take a look.

Mathematical

Mathematical because it is a complex system. The smallest variable can have a huge effect on the result. The farther into the future you try to base your prediction, the harder it is. Prof. Sir Micheal Berry tried once to forecast the path of a snooker ball. The first impact on the table was easy. By the second he only had a 30% of predicting the contact point. By the 9th it was near impossible. He would have needed to include in his equation the effects of every single particle in the universe.

The same for everything else. take the market for example. You would have to predict not only is affecting the market politically - for example in 2022 the Ukraine war with Putin - but almost every other factor that contributes to it. How Austria will react to gas prices? What do Netflix's fewer subscription rates mean for the economy? How will inflation in the US affect gold prices? How a tweet from Elon Musk, saying he wants to buy out Twitter will affect the markets? And millions of other factors. Even how different AI - each programed by a different broker - will react and change stock prices.

And, the farther you try to predict the more difficult it is. You can predict what will happen within 10 minutes, with 50% accuracy. Everything further from that deadline is a crapshoot.

Psychological

The second reason is simpler still. We're not rational creatures. We're swayed by herd mentality. We blindly accept everything. We act all over the place. Just think about how many things you do, daily, that is contrary to what is beneficial to you in the long run. Our brain, heart, and every fiber of our being tells us not to do it — and yet we end up falling for it, time after time.

We are built to have self-destructive behavior. Economists of the IMF have actually said that it's this very same self-destructive behavior that has led to the fact that they've been off predicting 148 out of the past 150 recessions. We're really bad at making predictions and making decisions that are beneficial to us.

Not only that, since today, everything has become more open — from the market - your 5-year-old can invest in crypto - to businesses - start-ups pop up like flies — there's no way to create a predictive model. There Chamicka Pollock too many players interfering in it. Before, the market was controlled by some - by brokers and folks like Peter Lynch - today, if the GameStop Revolt though us anything, is that everyone can alter and upset the grand scheme.

Take everything we say with a grain of salt

And finally here's the doozy. Why does it matter?

A: It's mathematically impossible.

It's sociologically impossible.

C: we're still basing our lives and business models on what "experts" predict and tell us will happen if we follow their handbook. Hell, to a degree, that's basically what I've sold — me, Chamicka Pollock.

The mindset of gurus, mentors, and financial planners or business planners is based on authority. We're certain that we're the guiding light. The truth is, we're also learning as we go along. We just know how to sell what we've gleaned a bit better. We're horrible at everything except short-term forecasting.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Tuscaloosa Times news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Tuscaloosa Times.

More InformationBusiness

SectionRussia’s top oil company takes over largest rare earth deposit

MOSCOW, Russia: Russia's top oil company, Rosneft, has taken over control of the country's largest rare earth metals deposit, Tomtor,...

Volvo Cars steps up partnership with Google to make Android software

GOTHENBURG, Sweden: Volvo Cars is stepping up its collaboration with Google to become the lead development partner for Android automotive...

U.S. stocks in retreat after Trump wages war on European Union

NEW YORK, New York - U.S. stock markets fell Friday as President Donald Trump launched an extraordinary attack on the European Union,...

Levi’s to sell Dockers brand for $311 Million, focus on care labels

SAN FRANCISCO, California: Levi Strauss is parting ways with Dockers. The denim giant announced this week that it will sell the Dockers...

Canada’s inflation eases, but core prices rise

OTTAWA, Canada: Canada's inflation picture became more complicated in April, with headline inflation easing but core measures ticking...

Rollercoaster day for U.S. stocks Thursday

NEW YORK, New York - U.S. stocks had a volatile day on Thursday after the House of Representatives narrowly passed President Donald...

Alabama

SectionAppeals court clears Trump’s rollback plan for worker protections

WASHINGTON, D.C.: A federal appeals court recently lifted a block that had stopped President Donald Trump's administration from removing...

Marlon Humphrey Teases Alabama Football Documentary He Produced

Justin Robertson Add executive producer to Marlon Humphrey's rsum. The Ravens cornerback took to X Thursday to share a sneak peek...

Rams 2025 Opponent Breakdown: Titans, Week 2

Stu Jackson Our offseason opponent breakdown series on theRams.com rolls on with Los Angeles' Week 2 road opponent, the Tennessee...

Seahawks Sign Third-Round Pick Jalen Milroe

The Seahawks signed quarterback Jalen Milroe on Tuesday, the ninth member of their 2025 draft class to sign. John Boyle Seahawks...

What We Learned From Ravens Wired Inside the Draft

Ryan Mink From inside Combine interviews and the draft room, Ravens Wired dropped Monday night, offering a behind-the-scenes look...

Jets HC Aaron Glenn: Special Teams Will Always Be an Emphasis for Us

Unit Will Be Coordinated by Chris Banjo; Green & White Are Younger at Kicker and Punter Ethan Greenberg Aaron Glenn may have a...